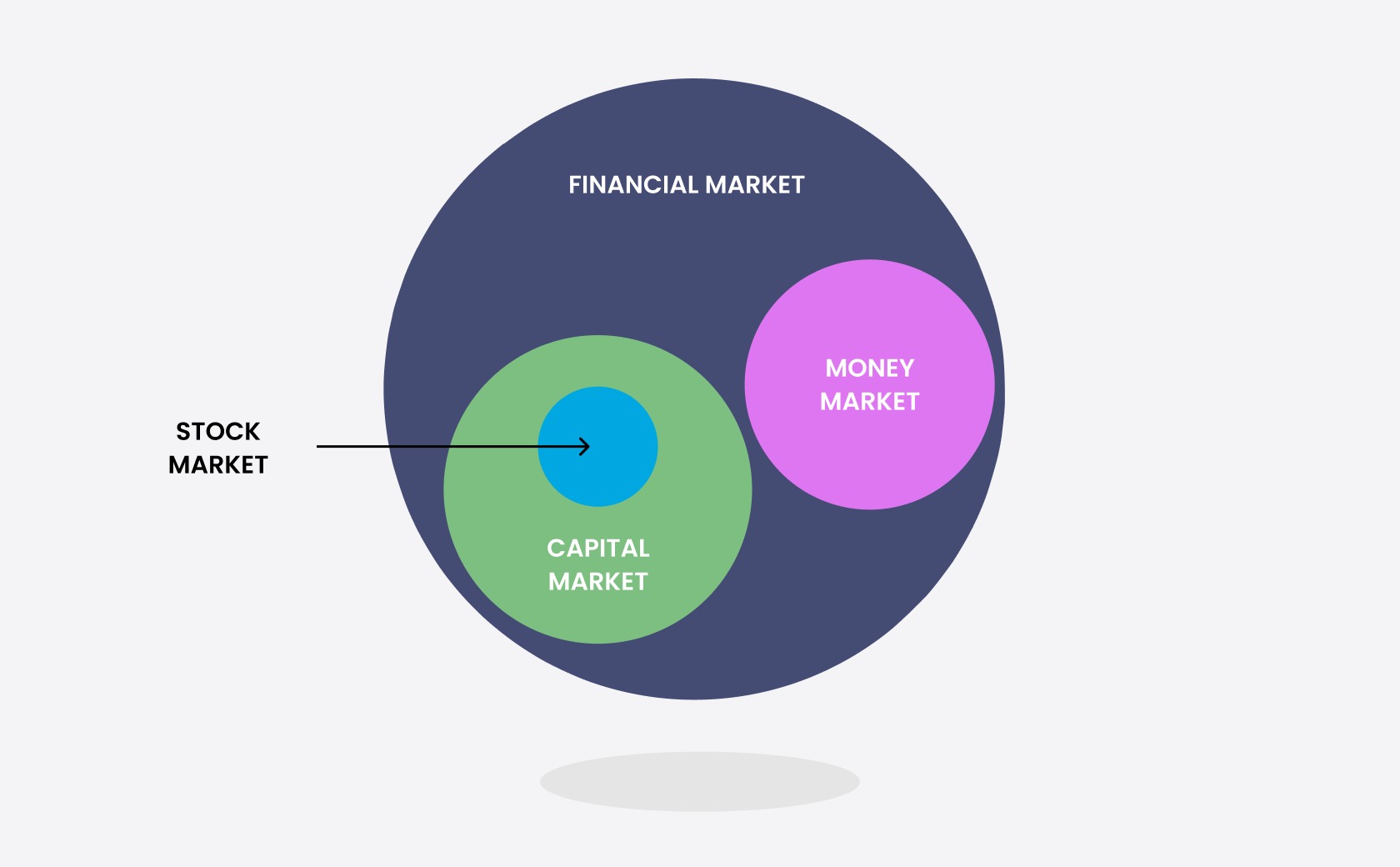

Understanding the difference in the middle money markets and capital markets is crucial for investors, financial analysts, and business managers. These two markets serve distinct purposes and cater to different types of financial needs. This article explains the specifics of each market, the instruments they use, and their respective roles in the financial ecosystem.

What is the Money Market?

The money market is a type of financial market where high-liquidity financial instruments with short maturities are traded. Typically, the maturities range from overnight to one year. The primary function of the money market is to provide short-term funding for the financial system, including corporations, governments, and other organizations.

Characteristics of the Money Market

- Short-Term Maturity: Instruments typically have maturities of one year or less.

- High Liquidity: The instruments are easily convertible to cash with minimal loss of value.

- Low peril: Due to the short maturities and high credit quality, the peril is generally lower compared to other financial instruments.

What is the Capital Market?

The capital market, on the other hand, deals with the trading of long-term securities. These include instruments with maturities longer than one year, such as bonds, equities, and other long-term investments. The primary purpose of the capital market is to raise capital for long-term investments by businesses and governments.

Characteristics of the Capital Market

- Long-Term Maturity: Instruments typically have maturities of more than one year.

- Higher peril: Given the longer duration and market fluctuations, these instruments generally carry higher peril.

- Potential for Higher Returns: The longer investment horizon and peril potential often lead to higher returns.

Money Market Instruments

Money market instruments are essential for maintaining liquidity in the financial system. They are generally short-term and include the following:

Types of Money Market Instruments

- Treasury Bills or T-Bills: T-Bills are short-term government securities that have maturities in the middle a few days to one year. They are considered one of the safest investments.

- Commercial Paper: Unsecured, short-term promissory notes issued by corporations, typically used for financing short-term liabilities.

- Certificates of Deposit (CDs): Time deposits offered by banks with specific fixed terms and interest rates.

- Repurchase Agreements (Repos): Short-term loans where securities are sold with an agreement to repurchase them at a higher price at a after date.

- Banker’s Acceptances: Time drafts guaranteed by a bank, commonly used in international trade.

Benefits of Money Market Instruments

- Liquidity: Quick conversion to cash.

- Safety: Low default peril due to high credit quality.

- Short-Term Investment: Suitable for investors looking for short-duration investments.

Capital Market Instruments

Capital market instruments are used to raise long-term funds. They include a variety of instruments, each serving different investment needs.

Types of Capital Market Instruments

- Stocks (Equities): Represent ownership in a company. Investors receive dividends and have the potential for capital appreciation.

- Bonds: Long-term debt instruments issued by corporations or governments. Bondholders receive recurring payouts and the return of principal at maturity.

- Debentures: Unsecured long-term debt instruments issued by companies, typically offering higher yields to compensate for the lack of security.

- Mutual Funds: Pooled investment vehicles that invest in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Investment funds traded on stock exchanges, similar to stocks, offering diversification across a range of assets.

Benefits of Capital Market Instruments

- Growth Potential: Opportunity for substantial returns over the long term.

- Diversification: Spread peril across different types of investments.

- Capital Formation: Enable businesses to raise large total of capital for expansion and development.